Last Friday brought a YUGE update in Neonode’s patent lawsuit vs. Samsung — a settlement is agreed in principle between our Swedish David and the Korean Goliath!! For more background, please check out my initial NEON write-up.

The settlement news is absolutely massive, but somehow feels a bit surreal. Why is the info so scarce, how come so few ppl have written about it (barring a handful clued-in folks like BBG Law’s Mike Shapiro) — and crucially, what does it mean for the stock?

Let’s begin with what we know. Firstly, on June 13 the parties issued a ‘Joint Motion to Stay All Deadlines and Notice of Settlement’ (screenshot below.) If we untangle the legal mumbo jumbo, it implies NEON and Samsung have 99% agreed to a deal, incl. settlement amount, and thus asked the court for a 30-day break in order to finalize the remaining details, eg stuff like payment schedule, communication plan, final doc checks and approvals, etc.

Remember, the lawsuit is independently run by stealthy litigation financier Aequitas Technologies (AQ,) which is why NEON has kept total radio silence. Once the deal is 100% done, the co’s required to issue some sort of official press release within roughly one week, likely through an 8-K given its Nasdaq-listing. The advantage for YOU, dear reader, is that this won’t show up in a vanilla stock screen, meaning algos likely piled on the shorts last Fri as the stock surged ~70%..

Secondly, we know that the announcement came in-between ‘Fact Discovery’ (ie docs, emails, etc) and ‘Expert Discovery’ (ie folks who may add more colour.) That seems like a peculiar timing, especially since the parties had agreed to extend a number of ‘Discovery’-related deadlines just weeks earlier. So why would Samsung be so eager to settle before the NEON side had gotten its expert ducks in a row?

My guess is NEON had some sort of ‘smoking gun’ evidence that they managed to confirm during ‘Fact Discovery.’ This notion is supported by the parties conducting a ‘Discovery Dispute’ hearing behind closed doors on May 19. Unfortunately, the transcript remains sealed (screenshot below) and we’ll likely never know exactly what transpired in front of the honorable Judge AA. Though, in my own dearly acquired experience, I’d assume it involved some serious ‘kimchi rage.’ 🥬♨️

If that is indeed the case, and NEON’s negotiator par excellence Kalpana made Samsung an offer they couldn’t refuse, this movie will have an even happier ending than the original ‘93 blockbuster. However, like any old classic, the plot will take some time to play out.

Thirdly, Samsung is only 1/3 of the tech troika our brave David is up against. NEON's companion litigation vs. Apple in California has been stayed (ie postponed) since Q4’24 pending a Samsung resolution (screenshot below.) That is about to change..

In all likelihood, as soon as a definite settlement agreement hits the legal Texan dock, the wheels of justice will slowly start moving again in California. Flush with cash, momentum and legal precedent, AQ should be in a strong position to battle it out on Apple’s home field. We’re getting a bit ahead of ourselves, but we may see a jury trial in ~1.5yrs. Or, we could get a settlement notice from Cali at any point in time. Then there is the behemoth Alphabet, who preemptively tried to claw away potentially tricky Android and/or Motorola questions, but got knocked back. In any regard, there is plenty of panem et circenses to go around…

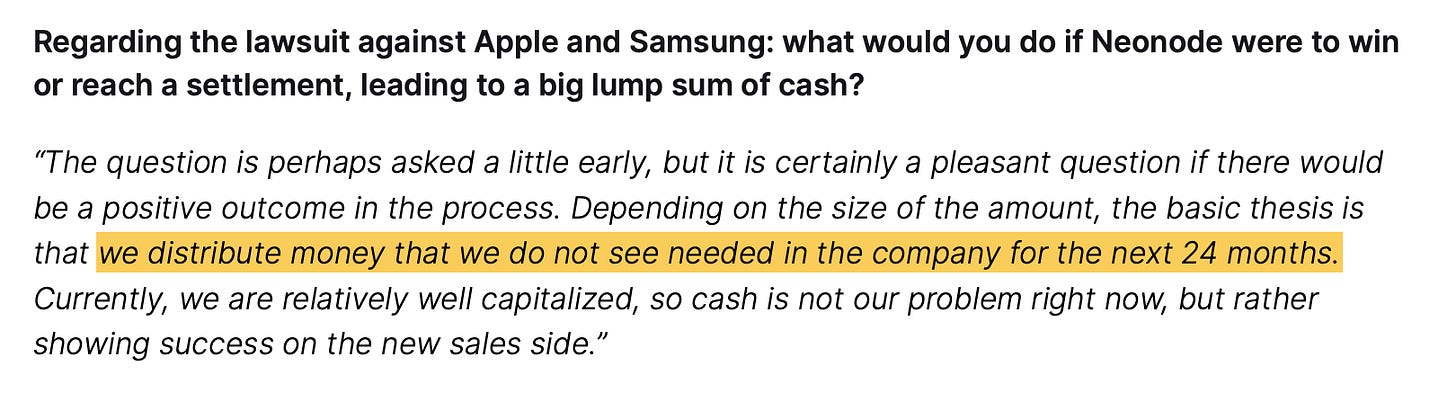

Lastly, from the interview NEON Chair Ulf Rosberg did with Redeye back in May'23 (screenshot below,) we can reasonably expect they’ll act in a shareholder friendly way. Both Rosberg and fellow BoD member Peter Lindell have deep corp fin/PE experience and skin in the game.

Quick recap. We know that (i) a settlement has been reached in principle between NEON and Samsung, which should be finalized in the next 30 days, (ii) timing of the announcement is intriguingly wedged between ‘Fact’ and ‘Expert Discovery,’ likely an indicator of NEON’s relative strength, (iii) lawsuit vs. Apple in California is now due to resume, and (iv) any windfall should be distributed to shareholders in a timely manner.

Gotcha shrimpster, but what's in it for MOI? Let’s quickly talk money. Key settlement amount factors incl. number of eligible units and value per unit, which will be subject to some haircut, and then NEON’s take rate. For simplicity, we’ll assume:

1bn units — US-only+; to partly compensate for worldwide sales

$4 per unit — baseline EUR2/unit+; to partly compensate for patent infringement

50% haircut — settlement discount; ref Burford vs. Argentina

33% gross proceeds — adj. legal fees, etc, AQ NP split, tax; Redeye estimate

17mn shs outstanding — assumed no further dilution; ref Rosberg’s comments

Est. Samsung net settlement: (1bn x $4 x 0.5 x 0.33) / 17mn ~ $40/sh Roughly speaking, $1bn gross settlement equals ~$20/sh (note this will vary depending on headline settlement amount due to fixed and variable cost dynamics.)

Let’s compare our napkin math to the consensus among shrimps and whales on the X/Twitter-sphere:

Big shout-out to everyone who voted — you guys put the wisdom back in the crowds! As a sense check, patent OG Andreas Iwerbäck, who absolutely nailed his ‘100% sure’ settlement call back in Sep’24, predicted a Samsung settlement ‘in the billions.’

In sum, NEON’s current stock price either suggests Mr Market thinks option ‘<$1bn 🥲’ is the most plausible — or, we’re just early to the party. Keep in mind, the price should also embed weighted upside for Apple and Google lawsuits as well as some value for the core business and net cash.

While we await further info, all we can do is keep the good discussion going, make informed guesses and enjoy the sleepless nights in Se(a)ttle..

‘Well, I'm gonna get out of bed every morning... breathe in and out all day long. Then, after a while I won't have to remind myself to get out of bed every morning and breathe in and out... and, then after a while, I won't have to think about how I had it great and perfect for a while.’ —Sam Baldwin, Sleepless in Seattle

Comments and questions always welcome.

Shrimp out.

Disclaimer: I’m long NEON. The content on this website is for informational and educational purposes only and is not created to meet your personal financial situation. Nothing should be considered as investment advice or as a guarantee of profit. You are advised to consult with your financial advisors to discuss your investment options and whether it would be a suitable investment for your personal needs. The information used in this publication is from sources that are believed to be reliable, but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and the author only. These opinions are subject to change without prior notice.

If $Neonode chooses to go to court and the jury rules in their favor, and if they are awarded $2.00 per unit in licensing fees with 3x punitive damages applied, the total judgment could reach $9 billion.

If they receive $1.50 per unit and only 1x (no punitive damages), the total amount would be $2.25 billion.

If Neonode receives a gross settlement of $3 to $4 billion and 50% of that goes to Aequitas, which covers all legal costs, Neonode would retain $1.5 to $2 billion. After applying an estimated 21% U.S. corporate tax on Neonode’s share, the net proceeds would be approximately $1.185 billion in the case of a $3 billion settlement, and $1.58 billion in the case of a $4 billion settlement.

With 16.5 million shares outstanding, this would translate to a net value of approximately $71.82 to $95.76 per share. These figures reflect the after-tax value of Neonode’s portion of the settlement, assuming no other significant deductions or obligations.

If the final settlement ends up being between $1 billion and $2 billion, and 50% of that goes to Aequitas (who covers all legal costs), Neonode would retain between $500 million and $1 billion. After applying an estimated 21% corporate tax, the net amount to Neonode would be approximately $395 million to $790 million.

With 16.5 million shares outstanding, this would result in a net value of approximately $23.94 to $47.88 per share.

If the licensing value is estimated at $4 per unit, then a settlement in the range of $1 to $2 billion would be unreasonably low relative to the potential damages.

For example, if Samsung used the technology in 1.5 billion devices, the actual damages based on $4 per unit would amount to $6 billion. If a jury were to apply 3x punitive damage, which is common in cases of willful infringement,

the total judgment could reach $18 billion.

Neonode can clearly prove that its technology was used in a massive number of Samsung devices , likely in the billions. Given prior licensing history, Samsung cannot deny awareness, which makes the risk of willful infringement and triple damages very real. With court exposure potentially reaching tens of billions, a multi-billion dollar settlement is not only likely!

it’s the smart move for Samsung.

Thanks for posting this! I'm also a big fan of NEON and added to my position this week. Curious what you think of ParkerVision? Also been holding that one in hopes of a settlement in 2025